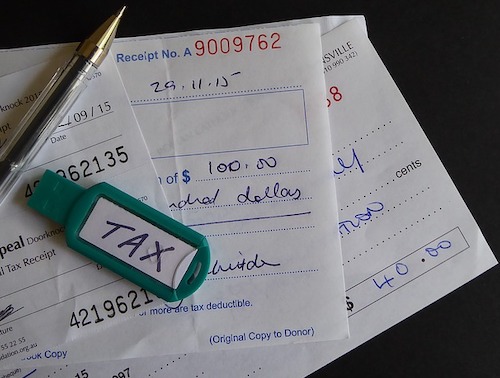

It’s easy to start thinking about charitable giving this time of year. Altruism and genuine interest in charitable causes aside, giving to charities can be a very useful deduction to write in while planning for next year’s taxes.

Many Saddock Wealth clients have a surplus of money they’d like to give (and write-off). However they aren’t always exactly sure the best way to give to their favorite charities while also collecting the tax benefits. Luckily, we’ve got some ideas.

Outright Gifts

This is the simplest way to donate and collect a tax deduction for it.

Giving a gift of cash, or even of marketable securities such as stocks, qualifies you for an itemized deduction. Outright gifts can also come in the form of real estate donations, although these are much fewer and far between.

It is important to note, though, that the standard deduction almost doubled with the Tax Cuts and Jobs Act. Therefore your itemized deductions will have to be at or over $12,000 for a single person or $24,000 per couple, to make it worth itemizing.

Donor-Advised Funds (DAFs)

Some of you may already have DAFs. But for those who don’t, these are accounts set up between a donor and a charitable organization. The donor of a DAF will put their personal assets into an account where they can be invested without being taxed. They are then taxed when the donor makes a grant to the charitable organization.

DAFs can be a pretty good setup, as you are able to deduct a lot from them. Plus the administrative burden is placed on the charity. This way, you don’t have to take time out of your busy schedule to manage them.

Charitable Gift Annuity

Charitable gift annuities can be a good option as far as tax-deductible charitable donations go, albeit not being extremely common.

Do you know a charity you want to support continuously, but don’t want to go through the hassle of giving outright gifts and itemizing your deductions each year? A charitable gift annuity may be right for you.

This is a contract between a donor and a charity of their choosing. The donor gives a gift of cash or other assets in exchange for a life annuity from the charity.

Unlike some other, simpler forms of charitable giving, a gift annuity is both a charitable gift and a purchase of a lifelong annuity contract with the charity.

As with DAFs, the administrative burden or charitable gift annuities is placed on the charity. Usually, it works out that the donor will be able to deduct the difference between the value of the gifts transferred and the annuity received.

Family Foundations

Foundations are more involved and complex than many other forms of charitable giving. However, they can be a good option for families with significant wealth and an interest in giving.

For these foundations, a family would establish a private fund for the purpose of charitable giving.

Typically, family foundations give out most donations through grants, which the donor may have complete control over. This requires substantial administrative work, as well as the capital required to set up a family foundation.

If successful, though, they can do a tremendous amount of good, and be very beneficial for tax purposes.

Art Donations

If you’re an art collector, or have valuable pieces in your family, gifting art or other tangible items is a form of charitable giving to consider.

However, giving (and deducting) tangible items requires some upfront research, as not all charities are able to accept these sorts of gift. The amount you can deduct is also variable, as many factors go into account. For example, there are factors of whether or not you’re classified as a dealer. Another factor is how the charitable organization intends to use the gift.

Retained Life Estate

Setting up a retained life estate is a big commitment. But it can be well worth it for donors with second homes, inherited family estates, farms, or the like.

When gifting a residence to a charitable organization, the donor retains the right to occupy the property for life. After death, the property will pass onto either the charity or the death of the last person with an interest in the property.

There are many more ways to gift your assets (and deduct those gifts), but this list should be a good start. We are always happy to brainstorm and advise on the most effective ways to handle your wealth, and if it can involve charitable giving, all the better.

Schedule a consultation here before next year’s tax filing! We look forward to meeting you soon!