As you’ve likely seen in the news, the recently passed Coronavirus Aid, Relief, and Economic Security [CARES] Act provides $350 billion for small businesses in several forms of economic relief to help with the challenges created by the COVID-19 pandemic. We are helping our clients determine which route to take and also navigate tax and compliance issues. We are processing loans for our clients as quickly as possible, and would like to schedule a zoom call with you and our tax team to discuss your options.

Explore your Business Funding and

Economic Disaster Relief Options Today.

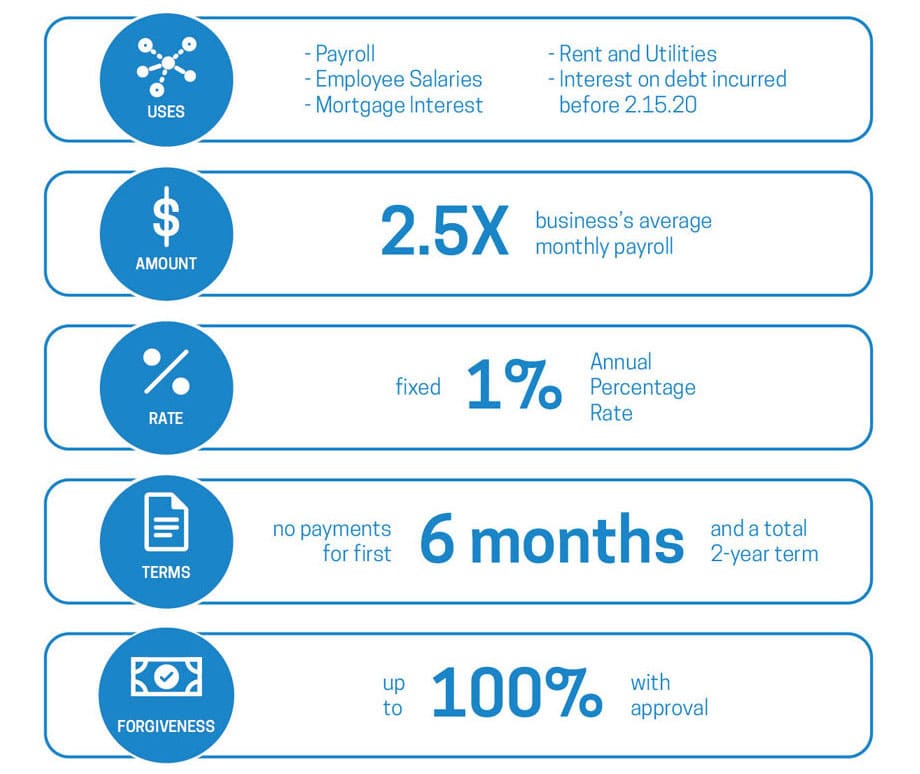

Payroll Protection Program

(including forgivable loan)

- This program [PPP] allows small business to receive a loan up to 2.5 times their average monthly payroll expenses, up to a total of $10 million.

- This loan may be forgiven, tax-free, in an amount equal to sums spent on qualified payroll, rent, mortgage interest, and utilities in the eight weeks following the loan.

- Amounts not forgiven must be repaid over ten years and will have a max interest rate of 4%.

- Tracking expenses and compliance will be essential to ensure forgiveness.

This information is accurate and updated as of April 8, 2020. Terms and conditions are subject to change.

Enhanced Economic Disaster Loan

- Businesses may apply for an economic disaster loan, but only if not applying for the PPP loan.

- These amounts are generally not forgivable but are offered on favorable terms such as low-interest rates and long payment periods.

- For loans under $200,000, there are no collateral or personal guarantee requirements.

- A business might choose this option over the PPP if more capital is desired than available under the max PPP amount.

Other Favorable SBA Loan Changes to Note

- All existing SBA loans may be deferred for at least six months.

- Increases the amount available for SBA lending and relaxes the standards to qualify.

Schedule Your Consultation

We’re motivated by service-driven solutions and want to help you and your family preserve and grow your wealth. You’ve worked too hard to leave your assets to chance, exposed to market risk or commission-hungry brokers. We offer investment advice, insight, and all services associated with wealth management and planning so you can keep more of what you’ve built.